Healthcare Spending Account: Rules and Tax Benefits for Canadians

A healthcare spending account (HSA) is increasingly becoming an essential component of financial planning for Canadian business owners, especially those operating as incorporated entities. Designed to optimize healthcare expenses through tax-efficient strategies, HSAs serve as flexible tools that offer considerable benefits while complying with CRA regulations. This comprehensive guide explores how healthcare spending accounts operate […]

Understanding Health Savings Accounts in Canada and How They Differ

A health savings account (HSA) is a well-known financial tool in the United States, celebrated for its tax advantages and flexibility in managing healthcare expenses. Many Canadians, upon hearing about HSAs in the U.S., become curious about whether similar options exist here in Canada. However, while the concept of tax-advantaged healthcare funding is universally appealing, […]

Step-by-Step Guide to Opening an HSA in Canada

How to Open an HSA in Canada: Step-by-Step Guide is a comprehensive resource designed to demystify the process of establishing a Health Spending Account (HSA) for Canadians. With financial methodologies evolving, especially among small business owners and incorporated individuals, understanding how to set up and leverage an HSA could be one of the most strategic […]

How Health Spending Plans Work for Incorporated Canadians

Navigating the intricacies of healthcare and tax planning as an incorporated Canadian professional can be daunting. Many business owners and self-employed individuals find themselves paying more than necessary for healthcare and taxes, often missing out on opportunities for savings. To optimize your financial health and maximize your benefits, understanding and implementing a health spending plan […]

In today’s ever-evolving business landscape, managing costs effectively while providing valuable employee benefits is crucial. The healthcare spending account is increasingly gaining recognition among Canadian entrepreneurs as a smart way to control healthcare expenses while maximizing tax benefits. A healthcare spending account (HSA) offers a flexible, CRA-compliant solution to cover a wide range of health-related […]

Canadian HSA Guide: Reduce Taxes and Healthcare Costs Effectively

In the realm of personal and business finance, few strategies offer the potential for significant savings as effectively as a Health Spending Account (HSA). For Canadians looking to mitigate the escalating costs of healthcare while simultaneously reducing tax liabilities, the HSA presents a compelling, often underutilized solution. This comprehensive guide will explore everything you need […]

HSA Insurance in Canada: How to Lower Your Out-of-Pocket Costs

Many Canadians still overpay for healthcare, not realizing hsa insurance can significantly reduce their expenses. With rising medical costs and the complexity of insurance plans, understanding how to leverage tax-advantaged accounts can make a meaningful difference in your monthly or annual healthcare spending. HSA insurance, specifically the use of Health Spending Accounts in Canada, offers […]

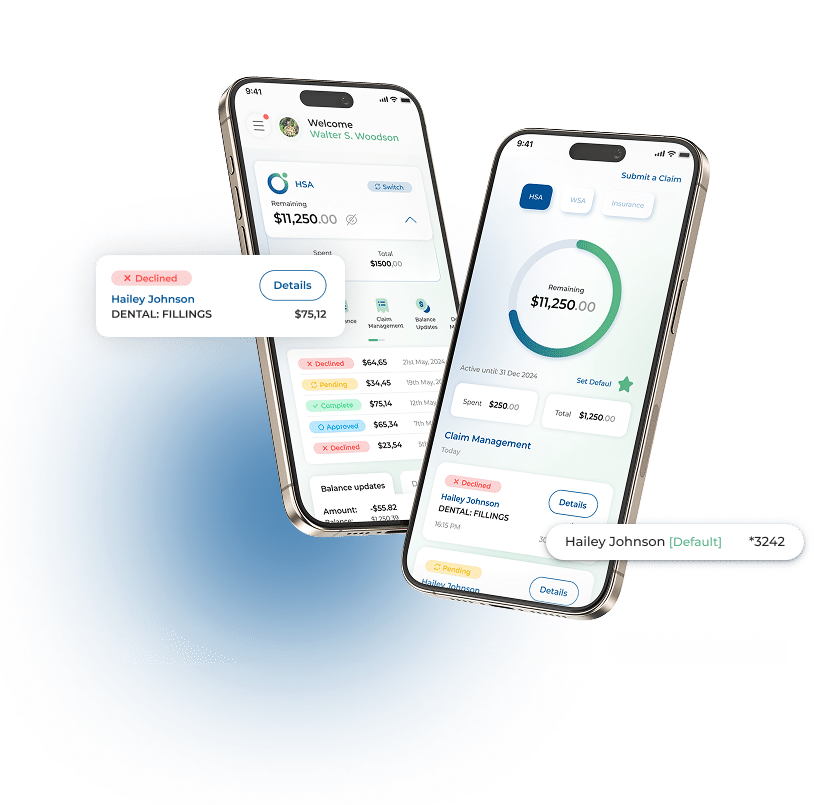

Understanding HSA Eligible Expenses in Canada: What’s Covered & What’s Not

Navigating the world of healthcare expenses and tax benefits can be complex, especially when it comes to HSA eligible costs in Canada. Understanding what expenses qualify for tax-free reimbursement through a Health Spending Account (HSA) is crucial for incorporated business owners, self-employed professionals, and small business owners looking to optimize their health-related spending. This guide […]

How to Maximize Your Health Benefits with an HSA

In today’s complex healthcare environment, many Canadians are seeking innovative ways to optimize their health benefits. While traditional health insurance provides essential coverage, it often leaves gaps that can cost you out of pocket. This is where Health Spending Accounts (HSAs) come into play—these are powerful tools designed for smarter, tax-free healthcare spending. By understanding […]