In the realm of personal and business finance, few strategies offer the potential for significant savings as effectively as a Health Spending Account (HSA). For Canadians looking to mitigate the escalating costs of healthcare while simultaneously reducing tax liabilities, the HSA presents a compelling, often underutilized solution.

This comprehensive guide will explore everything you need to know about HSAs in Canada — their benefits, costs, rules, and emerging trends. Whether you’re a self-employed professional, a small business owner, or someone seeking smarter healthcare funding strategies, this guide is your ultimate resource for understanding how to harness an HSA to optimize your financial health.

The hsa mechanism can be a game-changer, enabling tax-efficient reimbursement of health expenses. As you dive into the details, you’ll discover how this tool aligns with modern financial planning and Canadian healthcare realities. From core definitions to step-by-step implementation, this article provides expert insights designed to empower your financial decisions.

1. Introduction

Did you know a Health Spending Account (HSA) can be your secret weapon to save on taxes and medical expenses in Canada? While many Canadians rely on traditional health insurance plans, an HSA offers an innovative alternative or supplement that maximizes your healthcare dollars and tax benefits. This approach is especially advantageous for incorporated business owners and self-employed individuals, who often face higher costs and limited coverage options.

The purpose of this comprehensive HSA guide is to shed light on how these accounts function, their key benefits, the rules governing their use, and the future trends shaping healthcare funding. As healthcare costs continue to rise, exploring tax-advantaged accounts like the HSA becomes more relevant than ever. Whether you’re new to this concept or seeking to optimize your existing setups, understanding the mechanics and strategic advantages of an HSA empowers you to make smarter financial choices.

Furthermore, in an era where tax efficiency is crucial for small business owners, the opportunity to leverage an HSA aligns seamlessly with the Strategic Growth Enterprise (SGE) goals of maximizing profits while minimizing liabilities. So, what exactly is an HSA in the Canadian context? In brief, an HSA functions as a tax-advantaged account that can reimburse eligible health expenses, providing flexibility and savings potential. In the upcoming sections, we’ll delve into the detailed definition, benefits, practical examples, and step-by-step implementation tips to help you harness this tool effectively.

2. Core Definition of HSA

What Is an HSA?

An HSA, or Health Spending Account, is a special financial account that allows self-employed individuals and incorporated business owners in Canada to cover health-related expenses using pre-tax dollars. Essentially, it is a customizable account designed to reimburse out-of-pocket medical costs that are eligible under CRA guidelines, providing a means to optimize healthcare spending while enjoying significant tax advantages.

Unlike traditional insurance plans that pool risk and administer claims through premium payments, an HSA functions as a flexible spending tool. You fund the account with pre-tax income, and later, when you incur eligible health expenses, you can submit claims for reimbursement. The key advantage lies in the ability to do so tax-free, significantly reducing overall healthcare costs and increasing your savings potential.

For incorporated professionals such as chiropractors, physiotherapists, or consultants owning small businesses, an HSA offers a tailored approach to managing health expenses without the burden of high premiums or complex insurance plans. This flexibility allows for better control over healthcare spending, aligned with personal and business financial strategies.

How It Works for Incorporated Business Owners and Self-Employed Professionals

Incorporated business owners and self-employed professionals can leverage HSAs as part of their overall compensation and tax planning strategy. These accounts are established through CRA-approved providers and are linked directly to the business entity, making them a tax-efficient way to fund and reimburse health expenses.

Typically, the employer—meaning your business—contributes pre-tax dollars into the HSA. When you need to pay for eligible expenses such as dental work, prescriptions, physiotherapy, or vision care, you submit claims directly to the account provider, who processes the reimbursement. Since these claims are considered a tax-free benefit, they do not add taxable income, leading to potential savings on both corporate and personal taxes.

For self-employed professionals, HSAs replace or supplement traditional health insurance by offering a more flexible, cost-effective solution. Rather than paying high premiums, you allocate funds into your HSA and utilize it as needed. This enables precise management of healthcare expenses, aligns with unpredictable healthcare needs, and fosters better cash flow management over the fiscal year.

A common misconception is that HSAs are exclusively for larger corporations; however, CRA regulations explicitly support their use by small closely-held companies, sole proprietors, and independent contractors. They are an excellent tool for those looking to streamline health expense management while enjoying tax advantages.

Comparison with Traditional Health Insurance

Traditional health insurance in Canada typically involves paying monthly premiums in exchange for coverage of a broad range of medical expenses. While insurance provides risk mitigation and peace of mind, it often comes with high costs, limited flexibility, and complex claim procedures.

In contrast, an HSA offers a more adaptable approach. With an HSA, you fund the account with pre-tax dollars and reimburse yourself for eligible expenses directly, without the need for ongoing premiums. This flexibility means you aren’t tied to rigid coverage plans, allowing you to choose only those healthcare services that suit your specific needs.

Furthermore, HSAs empower users to manage healthcare costs proactively. Instead of accepting the fixed coverage parameters of insurance plans, you decide how much to contribute, which services to prioritize, and when to claim expenses. This targeted approach often results in cost savings, especially when used appropriately for common qualifying expenses like dental care or physiotherapy.

A crucial distinction is the potential for significant tax savings. Insurance premiums are generally paid with after-tax dollars, whereas HSA contributions and reimbursements are tax-advantaged. This difference can amount to substantial savings over time, making HSAs an attractive alternative or complement to traditional insurance.

For those interested in further exploring this comparison, our detailed article “HSA vs Health Insurance in Canada” provides an in-depth analysis, highlighting scenarios where an HSA can outperform standard insurance plans and how to integrate both into a comprehensive health strategy.

3. Key Benefits Of Using an HSA

One of the main reasons Canadians and small business owners are increasingly adopting HSA strategies is the range of benefits they offer. These accounts combine tax advantages with flexibility, cost control, and simplicity, making them an appealing addition to any healthcare or financial plan.

Tax-Free Reimbursements for Eligible Medical Expenses

The most compelling benefit of an HSA is the tax-free nature of reimbursements for eligible health expenses. Under CRA guidelines, qualifying expenses include a wide array of healthcare services such as dental care, vision correction, physiotherapy, prescriptions, and even some alternative health treatments. When you submit a claim for these expenses, the reimbursements are not taxable, effectively reducing your out-of-pocket costs.

This tax advantage means that, unlike insurance premiums, which are paid with after-tax dollars, HSA reimbursements do not increase your taxable income. As a result, your overall tax bill decreases, boosting your net savings. This benefit is especially significant for high-income earners or self-employed professionals who face higher marginal tax rates, amplifying the savings potential.

Moreover, because HSAs are flexible, you can accumulate unused balances year after year, allowing for strategic planning. You might choose to carry over funds for future needs, or use them to offset more expensive treatments down the line. This adaptability ensures that your healthcare dollars work efficiently for your specific circumstances.

Flexibility to Cover a Wide Range of Health-Related Costs

Unlike traditional health insurance plans with rigid coverage rules and limited reimbursable expenses, HSAs operate on a principle of flexibility. They can cover many types of health-related costs, including those that are often excluded from standard insurance policies or not covered fully.

Common eligible expenses include dental treatments like orthodontics and crowns, vision care such as glasses and contact lenses, physiotherapy sessions, hearing aids, prescriptions, and even certain over-the-counter medications with physician’s recommendation. Some alternative treatments like acupuncture, massage therapy, or chiropractic care may also qualify, depending on CRA guidelines and provider agreements.

This broad scope allows individuals and business owners to tailor their healthcare spending according to personal needs. For example, if you or your employees require ongoing physiotherapy, managing those expenses through an HSA can result in substantial savings and greater control. The ability to customize coverage broadens your healthcare options beyond what traditional insurance often offers.

Additionally, HSAs can be used to reimburse health-related travel expenses, purchase health monitoring devices, or cover expenses for mental health services, further enhancing their utility. This level of flexibility ensures that healthcare costs are less of a burden and more aligned with your specific health priorities.

Cost Control for Business Owners

Business owners and self-employed individuals often grapple with unpredictable healthcare costs and high insurance premiums. An HSA offers a solution by functioning as a cost-effective alternative that enhances financial control.

Since contributions to an HSA are made pre-tax, they immediately reduce your taxable income. This means your business pays less in taxes while building a dedicated fund to cover health expenses. If done strategically, the savings on taxes can be significant, sometimes exceeding the actual amount spent on healthcare, depending on your income level and contribution limits.

Moreover, HSAs give you control over the funding amount and timing. For instance, you can decide how much to contribute annually based on anticipated healthcare needs and cash flow. If you have a low-health year, you might contribute less or even carry over funds to subsequent years, creating a financial buffer.

From a cost perspective, HSAs can also reduce the need for expensive health insurance plans, which often come with high premiums and deductibles. Instead, you retain autonomy and flexibility, direct your healthcare dollars explicitly, and avoid paying for coverage that you may not fully utilize.

In summary, HSAs empower business owners to manage healthcare expenses proactively, optimize tax savings, and align health costs with their overall financial strategies. This flexibility is increasingly recognized as a vital component in modern, sustainable small business finance.

4. Relevant Examples of HSA Usage

Understanding the practical application of an HSA requires concrete examples that reflect regional healthcare costs and regulations. Let’s explore common eligible expenses across Canada and examine a real-life case illustrating the savings potential.

Examples of Common Eligible Expenses in Canada

In Canada, the CRA outlines a broad spectrum of eligible health expenses that can be reimbursed through an HSA. These include:

- Dental Services: Basic cleanings, fillings, orthodontics, crowns, and implants.

- Optometry and Vision Care: Eye exams, glasses, contact lenses, and laser eye surgery.

- Physiotherapy and Chiropractic Care: Sessions for physical rehabilitation, spinal adjustments, or injury treatment.

- Prescriptions and Medications: Non-insured medications prescribed by a healthcare provider.

- Hearing Aids and Aids for Hearing: Devices, repairs, and batteries.

- Mental Health Services: Psychologists, counselors, and private therapy sessions.

- Alternative Medicine: Acupuncture, massage therapy, naturopathy, and some herbal treatments.

- Medical Devices and Supplies: Blood glucose monitors, mobility aids, and orthotic supports.

- Travel for Medical Treatment: Expenses related to traveling for specialized care.

The wide-ranging scope allows individuals and business owners to tailor their health management approach while enjoying tax benefits.

You can read about the detailed list of eligible expenses here.

Case Study: Ontario-Based Small Business Owner Saving $3,000 Annually

Consider Sarah, a self-employed physiotherapist based in Ontario. She owns a small incorporated business and uses an HSA to cover her healthcare costs. Annually, she estimates $4,000 in eligible expenses, including physiotherapy, eye care, dental, and prescriptions.

By establishing an HSA and contributing $4,000 pre-tax, Sarah can reimburse herself throughout the year for these expenses. Since Ontario’s marginal tax rate is approximately 43.41%, she can potentially save over $1,700 in taxes alone on her contributions and reimbursements. Moreover, the reimbursement itself is tax-free, so her out-of-pocket expense reduces significantly.

Her overall savings amount to around $3,000 annually, as she strategically leverages her HSA to manage healthcare costs proactively. This compares favorably to traditional insurance premiums, which might cost her closer to $6,000 per year, with limited flexibility and coverage.

5. Cost Breakdown with Scenario

Understanding the cost structure associated with HSAs is critical for strategic planning. This includes setup costs, annual administration fees, and potential long-term savings.

Average Administration Fees for HSAs in Canada

The administrative fees for HSAs in Canada vary by provider and account size but generally fall within a manageable range. Most providers charge an initial setup fee of approximately $100 to $200, with annual maintenance fees between $50 and $150. Some providers offer tiered pricing based on account activity or contribution levels.

It’s important to compare providers carefully, as features, customer service, integration with accounting systems, and online claim processing can significantly affect overall value. The choice of provider impacts not only costs but also the ease of claim submission, recordkeeping, and compliance support.

Example Scenario: Incorporated Chiropractor Earning $100,000/Year

Let’s consider an incorporated chiropractor earning $100,000 annually, with $5,000 in healthcare expenses. She contributes $6,000 into her HSA, which is within CRA contribution limits, and uses it to cover her health expenses. Her tax savings on the contribution, assuming a 35% marginal tax rate, are approximately $2,100.

Potential Savings Breakdown:

| Income Bracket | Estimated Tax Savings | Healthcare Expenses Covered | Net Out-of-Pocket |

| $50,000 | $1,750 | $3,000 | $1,250 |

| $75,000 | $2,625 | $4,000 | $1,375 |

| $100,000 | $3,500 | $5,000 | $1,500 |

This table demonstrates how higher income brackets benefit more from the tax-deferral aspects of HSAs, translating into substantial savings. Combining lower administrative fees with strategic contributions maximizes the value of an HSA for incorporated professionals.

6. Step-by-Step Process to Open an HSA

Implementing an HSA in Canada involves several systematic steps. Each stage ensures compliance with CRA regulations and optimal utilization of the account.

Confirm HSA Eligibility (Must Be Incorporated)

Prior to setting up an HSA, confirm that your business is incorporated and that your business structure qualifies under CRA guidelines. Sole proprietors operating under a corporate structure are typically eligible, provided the account is established in the business’s name. Self-employed professionals with incorporated status can leverage HSAs to their advantage, but unincorporated sole proprietors may face limitations.

Verification of eligibility ensures adherence to CRA rules, avoiding future audit complications. Consult with a tax professional when in doubt, especially regarding legal and compliance considerations.

Choose a CRA-Compliant HSA Provider

Selecting the right provider is crucial. Look for providers with CRA-approved documentation, seamless online claim processing, secure data handling, and transparent fee structures. Some providers specialize in small business accounts or offer integrations with accounting software, enhancing your administrative efficiency.

Review customer feedback, service offerings, and any additional features such as flexible contribution plans and detailed reporting. Choosing a reliable, compliant provider minimizes regulatory risks and streamlines account management.

Enroll and Set Your Annual Allowance

Once you’ve selected a provider, enroll your business, and specify your annual contribution limits based on CRA guidelines. Remember, contribution limits are set annually and depend on your employment structure and income.

Establish protocols for fund contributions, whether through direct deposits, payroll deductions, or manual transfers. Clearly define allowable expenses and set policies for claim submissions to ensure compliance and operational efficiency.

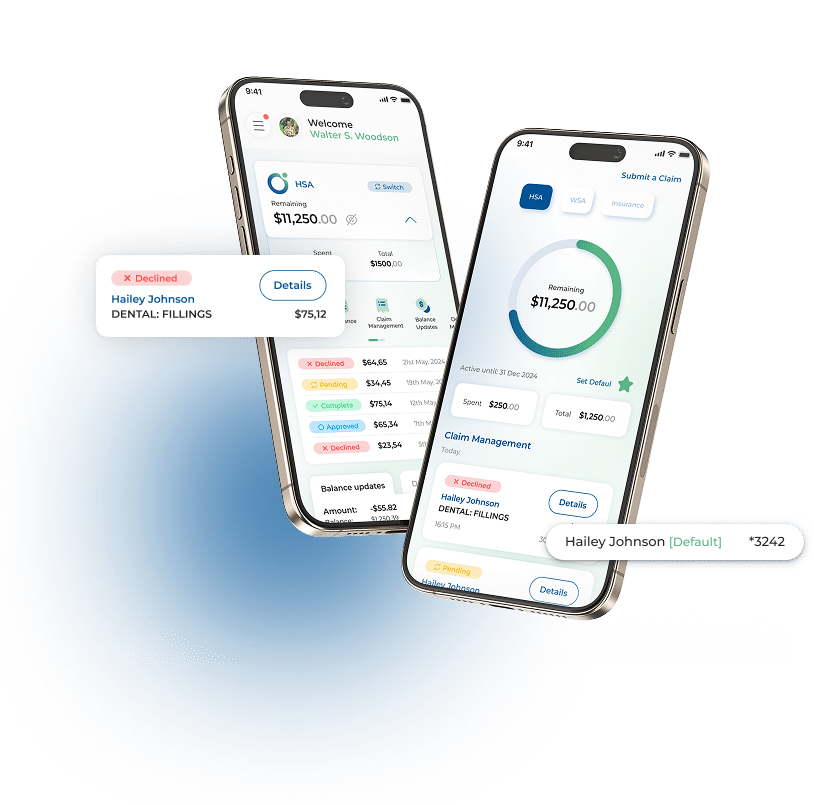

Submit Claims Online with Receipts

As healthcare expenses occur, submit reimbursement claims via your provider’s secure online portal. Attach receipts and documentation confirming the expense’s eligibility under CRA rules. Many providers accept scanned copies or photographs of receipts, simplifying the process.

Timely claim submission ensures quick reimbursement and accurate recordkeeping. Keep detailed copies of all receipts and proof of payment for your records and CRA audits.

Receive Tax-Free Reimbursement

Upon approval, the provider processes the claim, and you receive a tax-free reimbursement. This money can be transferred directly to your business or personal account, depending on your setup.

This reimbursement is not taxed and does not affect your taxable income, making it an efficient way to reduce healthcare costs while maintaining compliance. Regularly review and reconcile account activity to maximize benefits.

7. Rules & Compliance

Understanding the rules and regulations surrounding HSAs is essential for compliance and maximizing benefits. Here are common questions, along with detailed answers.

What Expenses Are CRA-Eligible?

CRA provides a comprehensive list of eligible health expenses, which include dental, vision, physiotherapy, prescriptions, hearing aids, and mental health services. Expenses must be deemed medically necessary and prescribed or provided by licensed providers.

Certain expenses, such as cosmetic procedures or over-the-counter medications without a prescription, may not qualify. It is crucial to verify each expense against CRA guidelines before claiming. Failing to do so can result in audits or penalties.

Can an HSA Replace Health Insurance?

While HSAs are valuable, they are not a complete replacement for traditional health insurance. Instead, they serve as a flexible supplement or alternative for specific expenses. Insurance provides comprehensive risk coverage, whereas HSAs focus on reimbursing out-of-pocket costs for eligible expenses.

Using an HSA alone requires careful planning to ensure coverage of more significant health needs, especially catastrophic events. Many small business owners utilize both strategies in tandem to optimize healthcare and tax efficiency.

Are There Contribution Limits?

Yes, CRA sets annual contribution limits based on your business size, income, and provincial regulations. For incorporated professionals, the limits align with CRA’s guidelines for tax-advantaged health accounts, typically $3,500 to $10,000 per year, but these vary depending on legislation and account type.

Exceeding contribution limits can lead to penalties, so tracking contributions diligently is vital. Consult your provider and tax professional to stay within permissible thresholds.

What Documentation Is Needed for CRA Audits?

Keep detailed receipts, invoices, and proof of payment for all expenses claimed. Maintain records for at least six years, including descriptions of services, dates, provider details, and reimbursement documentation.

Proper documentation ensures compliance during audits and supports your claims’ legitimacy. Digital records are acceptable, simplifying storage and retrieval.

Schema Opportunity: FAQ Schema with 4–5 Q&As

Implementing FAQ schema markup on your website helps search engines recognize your content as a rich FAQ for Canadian HSAs, increasing visibility and click-through rates. Focus on the questions above, providing clear, detailed answers that anticipate user needs.

8. Future Trends

As the Canadian healthcare funding landscape evolves, several emerging trends indicate promising opportunities for HSA adoption and innovation.

Increasing Adoption Among Small Business Owners

With rising healthcare costs and limited insurance options, more small business owners and self-employed professionals are turning to HSAs for flexible, tax-advantaged healthcare funding. Recent legislative adjustments and awareness campaigns further promote adoption, making HSAs a mainstream component of small business finance.

Digital HSA Platforms and Automation

The future points toward greater digitization and automation in HSA management. Cloud-based platforms facilitate easy claim submission, automatic receipt tracking, and real-time expense monitoring. Artificial intelligence tools can suggest optimal contribution levels, predict healthcare needs, and streamline compliance checks.

Such innovations will lower administrative burdens, increase transparency, and improve user experience, encouraging broader utilization and integration into holistic financial planning.

Potential Policy Updates from CRA

As healthcare costs rise and economic pressures mount, CRA may introduce policy adjustments to enhance the HSA framework. Possible updates include increased contribution limits, expanded eligible expenses, or streamlined compliance procedures.

Staying informed about legislative changes ensures you capitalize on new opportunities while maintaining compliance.

9. Conclusion

Harnessing an HSA in Canada is a strategic move that offers substantial tax savings, increased flexibility, and better control over healthcare expenses. By understanding its core principles, benefits, and implementation process, small business owners and self-employed professionals can significantly reduce their financial burdens and enhance their healthcare management.

As the landscape evolves with digital innovations and policy shifts, adopting an HSA positions you ahead in the quest for smarter, more efficient healthcare funding. Ready to start saving? Learn how Wellbytes can help you set up your CRA-compliant HSA today. Click here to get started with Wellbytes HSA and optimize your health and financial well-being.

Incorporate the power of an hsa into your financial strategy to cut taxes and healthcare costs effectively, ensuring a healthier, wealthier future.

Take the next step with Wellbytes

At Wellbytes, we specialize in helping businesses implement employer-sponsored health accounts, including Health Spending Accounts (HSAs), with ease. Our tech-driven platform simplifies benefits management, ensuring your employees get the healthcare support they need – without added stress for your HR team.