Wellbytes empowers incorporated individuals to maximize tax-free medical reimbursements through HSA.

Offer your employees reimbursement on a wide range of medical, dental, and health related expenses at 100% coverage as tax-deductible benefit.

You’ll receive full support and access to our innovative products and systems without Broker Licensing.

Whether incorporated or a small to large business, Wellbytes HSA is the only platform designed for you.

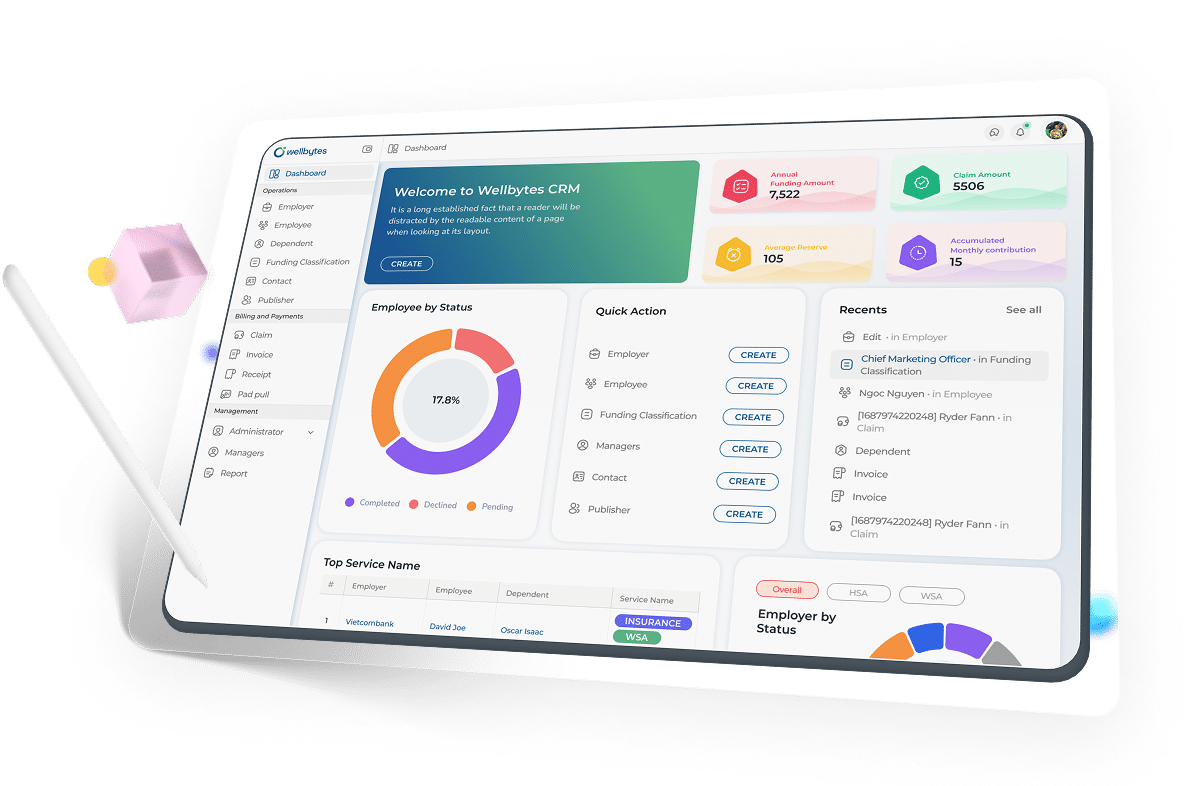

Manage benefits, track claims, and optimize health spending for your business with Wellbytes CRM

Start now with no setup fees and no hidden costs

Dedicated assistance for your business anytime

SOC2 Certified ensures your personal information is protected

A Health Spending Account (HSA) is a tax-efficient and cost-effective way for employers and sole proprietors to offer health benefits to employees, their dependants and themselves. Wellbytes HSA is fully funded by the employer.

Health benefits offered through this plan are 100% deductible to employers and 100% tax-free to employees. There are no premiums, hidden fees, deductibles, copay, or complex policies.

Your employees will be able to claim a variety of health, dental, and vision expenses without breaking their bank or category specific limits.

HSA’s in Canada are regulated under the CRA Income Tax Act. More information can be found in the Income Tax Folio S2-F1-C1. All eligible expenses can be found at the CRA website.

All employees are eligible for HSA in Canada.

It is arranged and sponsored by the employer to reimburse health care and dental expenses. The employer deposits a predetermined amount in the health spending account and all employees can benefit from it.

We charge a flat $2 + 10% admin fee that is negotiable depending on employer size (amount of employees), on every transaction (reimbursement of claim to employee).

Other than that, Wellbytes has:

No annual fees.

No setup fees.

No enrolment fees.

No maintenance fees.

All eligible medical expenses are determined and governed by the Canada Revenue Agency (CRA).

To see an extensive categorized list of eligible expenses:

To see an extensive list with detailed information of eligible expenses:

To begin your registration with Wellbytes:

A Wellness Spending Account (WSA) is an employer-funded benefit that supports employee well-being beyond traditional health coverage.

Unlike Health Spending Accounts (HSAs), which are limited to medical and dental expenses, a WSA can be used for a wide range of lifestyle and wellness-related costs. These may include fitness memberships, mental health programs, nutrition services, professional development, or other employer-approved expenses.

With Wellbytes, a WSA is fully customizable—employers decide the eligible categories and the budget for each employee. Employees then submit claims for reimbursement through a simple, paperless process.

It’s important to note that a WSA is considered a taxable benefit in Canada, meaning the value employees use is reported as income. However, for employers, it offers a flexible and cost-predictable way to invest in workforce wellness while giving employees choice in how they use their benefits. You can read more about on how to handle taxable benefits and allowances

A Wellness Spending Account (WSA) and a Health Spending Account (HSA) are both employer-funded benefits, but they serve different purposes and have different tax treatments.

Purpose:

HSA covers medical, dental, and vision expenses approved by the Canada Revenue Agency (CRA).

WSA goes beyond healthcare, allowing spending on broader wellness or lifestyle categories such as gym memberships, mental health apps, nutrition, or professional development (depending on employer policy).

Tax treatment:

HSA is a non-taxable benefit for employees when used on eligible health expenses, and contributions are tax-deductible for employers.

WSA is a taxable benefit, meaning any amount employees use is reported as income.

Flexibility:

HSA is limited to CRA-approved medical expenses.

WSA is highly customizable—employers decide what’s eligible, giving employees more lifestyle choice.

In short, HSAs provide tax-efficient healthcare coverage, while WSAs provide flexible lifestyle support that enhances overall employee wellness.

The expenses covered under a Wellness Spending Account (WSA) depend on what the employer chooses to include, making it one of the most flexible employee benefits. While a Health Spending Account (HSA) is limited to CRA-approved medical costs, a WSA can support a wide range of wellness and lifestyle needs.

Common categories of eligible expenses include:

Fitness & Recreation: gym memberships, fitness classes, sports equipment, yoga, or personal training.

Mental Health & Well-being: meditation apps, wellness retreats, counseling programs not covered by an HSA.

Nutrition & Lifestyle: dietitian services, meal plans, smoking cessation, or weight management programs.

Professional Development: courses, certifications, or skill-building workshops.

Family & Lifestyle Support: childcare, eldercare, or other family-related wellness services (if approved by the employer).

Because employers customize what counts as eligible, each company’s WSA may look different. This flexibility gives employees the freedom to choose benefits that best support their personal health and lifestyle.

Yes — many employers choose to offer both a Health Spending Account (HSA) and a Wellness Spending Account (WSA) as part of a well-rounded benefits package. Together, they give employees coverage for essential health expenses while also supporting broader wellness and lifestyle needs.

HSA ensures employees have tax-free coverage for medical, dental, and vision costs that align with CRA-approved expenses.

WSA adds flexibility by covering non-medical categories like fitness, mental health apps, professional development, and other wellness-focused benefits.

Offering both accounts can help employers:

Attract and retain talent with a more competitive benefits plan.

Support employees’ physical, mental, and financial well-being.

Maintain predictable costs by setting fixed budgets for each account.

In short, combining an HSA and a WSA balances health security with personalized wellness options, giving employees the best of both worlds.

Yes — as the employer, you have full control over what employees can claim through a Wellness Spending Account (WSA). Unlike a Health Spending Account (HSA), which is limited to CRA-approved medical expenses, a WSA is customizable. You decide:

Eligible categories: For example, fitness memberships, nutrition programs, mental health apps, childcare, or professional development.

Budget limits: How much funding is allocated per employee, per year (or per month/quarter, depending on your setup).

Claiming rules: Whether unused funds carry over or reset at the end of each period.

This flexibility means you can design a WSA that aligns with your company’s culture, budget, and employee needs. It also ensures your investment goes toward the types of benefits that matter most to your team.