Use Your Law Firm Business Structure to Unlock a Tax Savings Health Plan

Discuss Your HSA Solution for Legal Professionals

Complete your information below and we‘ll help you discover how an HSA allows you to expense your personal health expenses, through your legal business structure, while receiving a tax-free benefit. Our plans can extend to your family members at no extra cost.

What is a Health Spending Account

An HSA is a tax-free benefit plan provided by an employer that allows employees to be reimbursed for eligible medical expenses. It is approved by the Canada Revenue Agency (CRA) and is commonly used by small and mid-sized businesses to offer flexible health benefits.

How Can Lawyers Benefit from an HSA?

- Maximize tax deductions with every health-related expense.

- 100% CRA compliant — built for incorporated professionals.

- Fast reimbursements and minimal paperwork.

- Cover your family under your business sponsored plan.

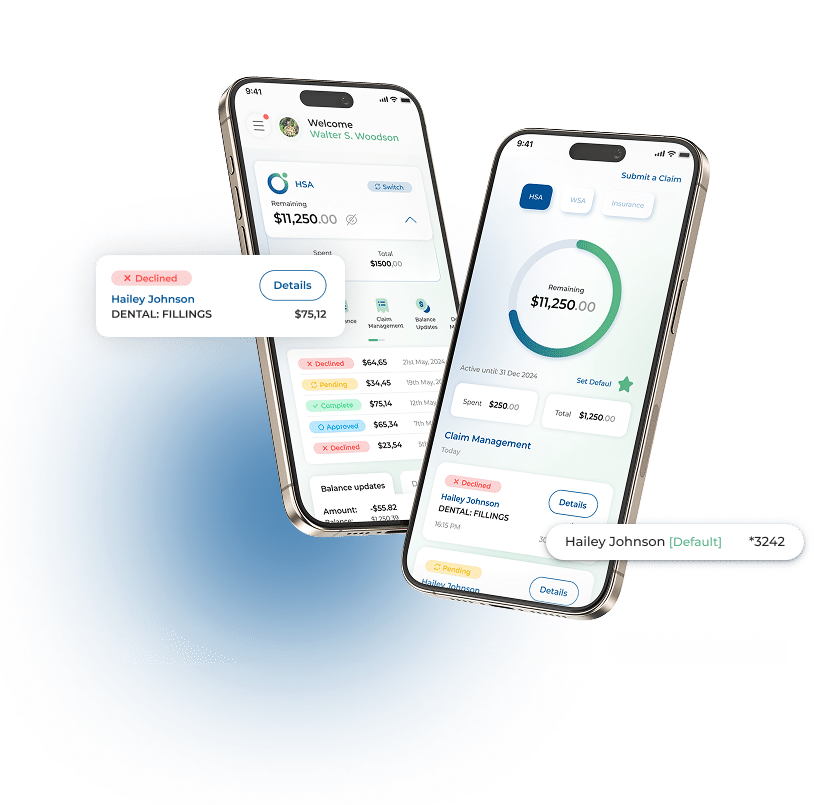

- Digital-first experience — file, approve, and get reimbursed from anywhere.

How One Lawyer Saved $2,400 in Taxes With a Health Spending Account

Meet Sarah. She runs her own legal firm in Toronto and earns $120,000 per year through her corporation. Like many lawyers who run their own business, Sarah pays for her health and medical expenses with after tax-income like:

- Orthodontics for her teenager: $3,000

- Glasses and vision exams: $800

- Physiotherapy sessions: $600

- Dental cleanings and fillings: $600

- Prescription medication: $400

| Without HSA | With a Wellbytes HSA Plan Including Our Price | Annual Savings for Sarah | Why Sarah Loves Wellbytes HSA Plans | |

|---|---|---|---|---|

| Annual Healthcare Costs | $5,400 (paid from after-tax income) | $5,400 (paid by corporation as deductible expense) + $350 (Wellbytes HSA annual fee based on claimed amount) | – | Turns personal expenses into business deductions—perfect for incorporated lawyers maximizing every dollar. |

| Pre-Tax Income Needed | $9,818 (to cover $5,400 after 45% combined Ontario tax bracket) | $5,400 (corporation deducts full amount; tax-free reimbursement) | $4,418 | Reduce corporate taxable income as an HSA is an eliglble business expense, without changing spending habits |

| Effective Tax Rate on Expenses | 45% (personal + corporate tax drag) | 0% (100% deductible + tax-free receipt) | – | CRA-compliant way to bypass personal taxes on health costs—ideal for high-income lawyers in 40-50% brackets. |

| Net Tax Savings (Annual) | $0 | ~$2,430 (45% of $5,400 deduction) | $2,430 | Real dollars saved yearly; compounds to ~$24,300 over 10 years—enough for a family vacation or RRSP top-up. |

| Breakdown of Sample Expenses | Orthodontics: $3,000 Glasses/Vision: $800 Physio: $600 Dental: $600 Prescriptions: $400 | Same expenses reimbursed 100% tax-free | Proportional (~45% per item) | Covers common lawyer needs (stress-related therapy, family dental, vision from long hours)—no category caps like insurance. |

| Long-Term Impact (10 Years) | $98,180 pre-tax earned to cover costs | $54,000 total (plus compounded savings if reinvested) | ~$24,300 | Builds wealth over a career; lawyers in peak earning years see the biggest compounding effect. |

| Compliance & Risk | Higher audit risk if used incorrreclty and when claiming through the Medical Exempt Tax Credit (METC). Tax credits also have a low cap | Fully CRA-compliant (IT-339R2 reasonable rules) with Wellbytes audit compliance resources and document storage | – | No tied selling or hidden fees—transparent setup protects busy lawyers from compliance headaches. |

That’s $5,400 (corporation deducts full amount; tax-free reimbursement) a year in out-of-pocket healthcare costs — paid from her after-tax income.

Now, let’s see how the math works:

If Sarah is in a combined 45% tax bracket (Ontario), she needs to earn $9,800 pre-tax to have $5,400 after tax to pay those bills.

Without an HSA, those medical costs effectively “cost” her $9,800 of corporate income.

But with a Wellbytes Health Spending Account, Sarah’s corporation pays those same $5,400 in medical expenses as a 100% deductible business expense.

That means:

Her corporation deducts $5,400 from taxable income.

She receives tax-free reimbursement personally.

Net tax savings: roughly $2,400 per year — with no change to her healthcare habits.

Over 10 years, that’s nearly $24,000 saved, just by running her health expenses through an HSA.

Lawyers like Sarah work hard for every dollar. An HSA helps you keep more of it — legally, efficiently, and CRA-compliant.

Want to speak to someone right away? Call 1-888-218-4549 during our business hours

of Monday to Friday from 9:00 AM to 6:00 PM EST and we’ll be happy to talk to you

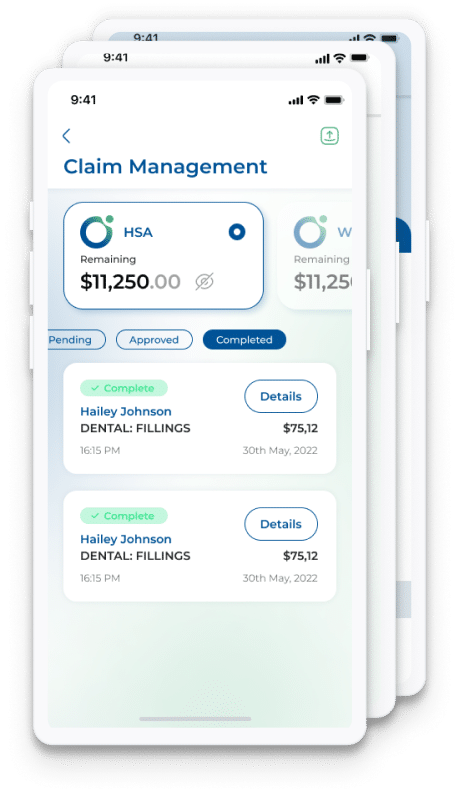

How Wellbytes HSA Works — In Just 3 Simple Steps!

Ready to schedule a consultation? Use the button below to schedule a call for a no obligation benefits consultation.

Smart and Simple

for Individuals or Employees

- Snap & Submit - Fast, Paperless Claims

- No Annual Fees

- Fast Direct Deposits for Claim Reimbursements

- Minimal Paperwork

- Automated Updates And Alerts

Frequently Asked Questions

1. How can an HSA help me lower my personal income taxes as a lawyer?

An HSA allows you to pay for personal and family healthcare expenses through your professional corporation using pre-tax dollars. Instead of paying out-of-pocket after tax, your corporation deducts the expense, effectively turning medical costs into a business write-off.

2. Can I use my professional corporation to pay for family medical expenses through an HSA?

Yes. If you’re an incorporated lawyer, your corporation can reimburse you and your family for eligible medical expenses under an HSA plan. The reimbursements are 100% tax-free to you personally and fully deductible to the corporation.

3. Is an HSA officially recognized by the CRA for legal professionals and incorporated law firms?

Yes. HSAs are governed under the Canada Revenue Agency’s Private Health Services Plan (PHSP) rules. As long as your plan is set up correctly, it’s fully compliant and recognized for incorporated professionals — including lawyers.

4. What medical and dental expenses are fully eligible under an HSA in Canada?

HSAs cover all CRA-approved medical and dental expenses, such as dental work, vision care, prescriptions, paramedical services (chiropractors, psychologists, physiotherapists), fertility treatments, and even orthodontics.

You can read here for detailed list of eligible expense

5. How does an HSA compare to traditional insurance or personal medical coverage for lawyers?

Unlike traditional insurance, an HSA has no premiums or co-pays. You only pay for what you actually use, and you get full reimbursement up to your limit. It’s more flexible, tax-efficient, and cost-effective for solo practitioners or small firms.

6. Can I include my spouse or dependents under my HSA plan?

Absolutely. Your spouse and dependents are eligible for coverage under your HSA, meaning your corporation can reimburse their healthcare expenses tax-free as well.

7. What kind of documentation or receipts do I need to stay compliant with CRA requirements?

You’ll need valid receipts from licensed medical providers showing the date, amount, and type of service.

With Wellbytes, all documentation is submitted digitally and stored for CRA compliance automatically.

8. How much can I contribute to my HSA each year, and are there any limits for legal corporations?

There’s no fixed CRA cap. The contribution limit is set by your corporation’s policy and should be reasonable relative to your income. Many incorporated professionals allocate between $2,500–$10,000 annually.

9. What happens if I have associates or staff — can I offer HSAs to them as part of a benefits package?

Yes! You can extend HSAs to employees, associates, or paralegals as a cost-effective alternative to group insurance. It’s a tax-free benefit that enhances retention and morale without complex administration.

10. How quickly can I get reimbursed for my medical or dental expenses through an HSA?

With Wellbytes, reimbursements are typically processed within 1–3 business days once your claim is approved. Funds are transferred directly to your business or personal account, depending on your setup.

Why Choose Wellbytes for Your Law Firm

Wellbytes doesn’t resell insurance or add unnecessary complexity to your plan. Our HSA model is transparent—no bundled insurance, no cross-selling. Lawyers can focus on their practice, not paperwork.

Other administrators may advertise low base fees but charge extra for setup, dependents, renewals, or even unapproved claims.

At Wellbytes, pricing is simple:

You only pay when your plan is used.

Fees apply only to approved claims.

No hidden costs—what you see is what you get.

This ensures your firm pays for value, not administration.

We believe in flexibility. Wellbytes has no cancellation fees or long-term lock-ins.

You can stop or adjust your plan anytime with no penalties—because we’re confident you’ll stay for the service, not the fine print.

Wellbytes is a technology company first, with projects and partnerships in Silicon Valley and global markets.

We’re independent—not owned by large insurance or trust companies—so we never push you toward policies you don’t need. Your firm’s plan remains fully within your control.

Every claim submitted through Wellbytes is 100 % reviewed for CRA compliance.

Unlike other administrators that perform random audits or ask for extra paperwork months later, our digital platform:

Reviews and validates claims in real time.

Provides instant feedback and documentation.

Ensures every submission is CRA-ready and audit-proof.

Want to speak with a real person? Wellbytes offers superior customer service so that when you want to talk to someone, you can! No AI chatbots, complex phone menus or rarely monitored inboxes. Our team understand the value of interaction and we use AI and technology where it matters.