Your HSA Journey Starts in 3 Minutes !

Discuss Your HSA Solution

Fill out a quick form. We’ll reach out with detailed, personalized advice on how an HSA can work just for you!

What is a Health Spending Account

An HSA is a tax-free benefit plan provided by an employer that allows employees to be reimbursed for eligible medical expenses. It is approved by the Canada Revenue Agency (CRA) and is commonly used by small and mid-sized businesses to offer flexible health benefits.

Who can use an HSA

Any employee enrolled in the HSA plan can use it. In incorporated businesses, the owner can also participate if they draw a salary.

Want to speak to someone right away? Call 1-888-218-4549 during our business hours

of Monday to Friday from 9:00 AM to 6:00 PM EST and we’ll be happy to talk to you

How Wellbytes HSA Works — In Just 3 Simple Steps!

Ready to schedule a consultation? Use the button below to schedule a call for a no obligation benefits consultation.

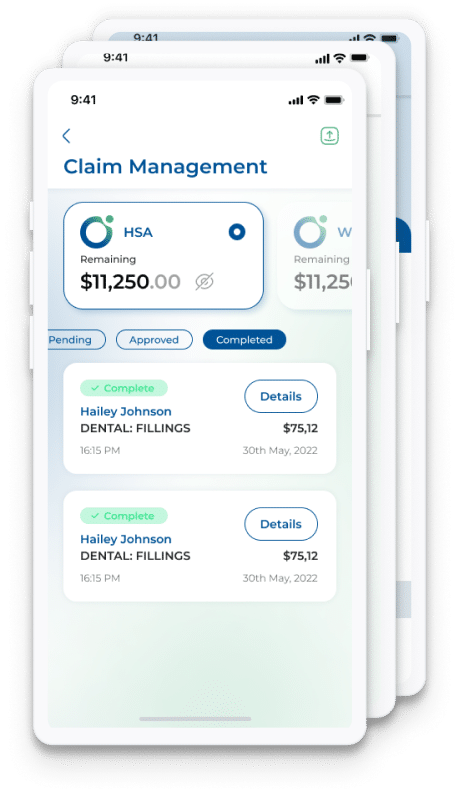

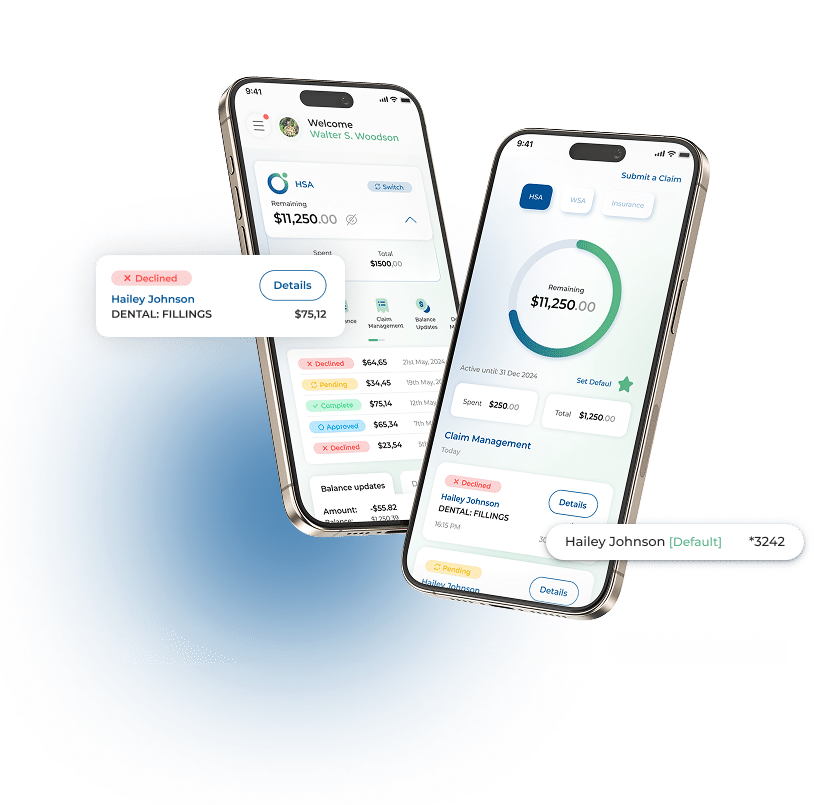

Smart and Simple

for Individuals or Employees

- Snap & Submit - Fast, Paperless Claims

- No Annual Fees

- Fast Direct Deposits for Claim Reimbursements

- Minimal Paperwork

- Automated Updates And Alerts

Frequently Asked Questions

1. What is a Health Spending Account (HSA)?

A Health Spending Account (HSA) is a tax-efficient and cost-effective way for employers and sole proprietors to offer health benefits to employees, their dependants and themselves. Wellbytes HSA is fully funded by the employer.

Health benefits offered through this plan are 100% deductible to employers and 100% tax-free to employees. There are no premiums, hidden fees, deductibles, copay, or complex policies.

Your employees will be able to claim a variety of health, dental, and vision expenses without breaking their bank or category specific limits.

HSA’s in Canada are regulated under the CRA Income Tax Act. More information can be found in the Income Tax Folio S2-F1-C1. All eligible expenses can be found at the CRA website.

2. Who is eligible for an HSA?

All employees are eligible for HSA in Canada.

It is arranged and sponsored by the employer to reimburse health care and dental expenses. The employer deposits a predetermined amount in the health spending account and all employees can benefit from it.

3. What fees does Wellbytes charge?

We charge a flat 10% admin fee that is negotiable depending on employer size (amount of employees), on every transaction (reimbursement of claim to employee).

Other than that, Wellbytes has:

No annual fees.

No setup fees.

No enrolment fees.

No maintenance fees.

4. What are some common eligible expenses covered under an HSA?

All eligible medical expenses are determined and governed by the Canada Revenue Agency (CRA).

To see an extensive categorized list of eligible expenses:

To see an extensive list with detailed information of eligible expenses:

5. How do I get started with Wellbytes?

To begin your registration with Wellbytes: